Survey - Consumer Behaviour Car Industry

Introduction

I prepared a survey with the Qualtrics survey tool and distributed it among a variant of target groups. The purpose was to determine how consumers behave when it comes to configuring/buying a car. Learning about the problems and needs of potential clients is a great way to be inspired and learn what to actually is necessary. By conducting a survey I will be able to work with real data/insights which avoid assumptions and preconceptions. In this way, I can get to the essence of the problem and focus on possible solutions.

Insights

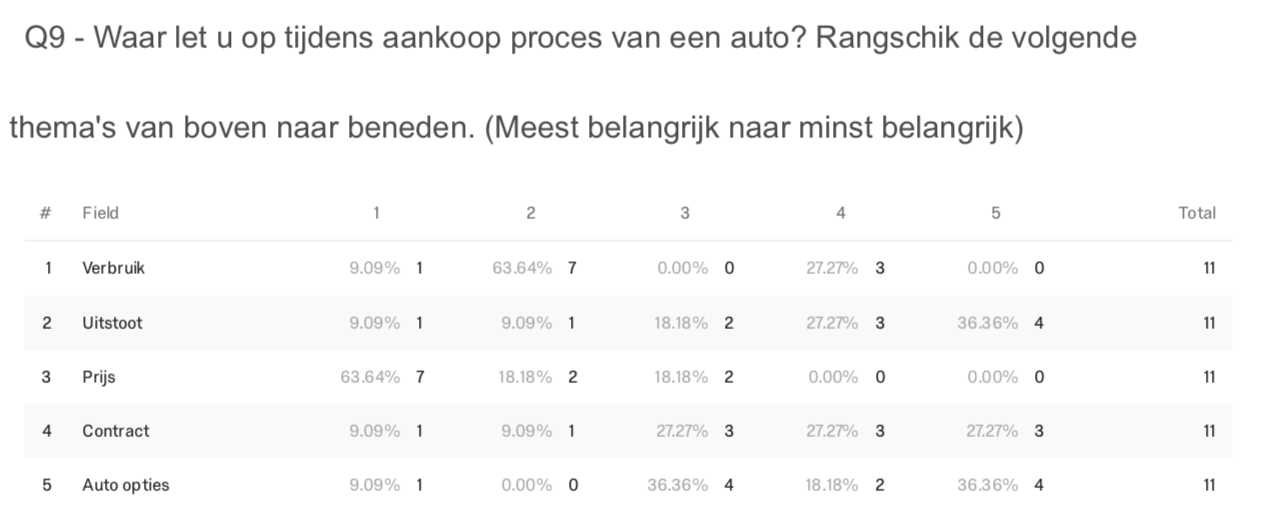

The first valuable insights rose from the question about what people find important while purchasing a car. I ask the participants to rank the question from one to five, where one is the most important and five the least.

As the figure above shows, the price is the most important without a doubt. Because signing a contract or buying a car is a moment where people are careful, providing a live (correct) price is essential. As second, people rate consumption. As consumption determines the variable costs (gasoline or diesel), people that a close look at the consumption level. People became more diverse after these two opinions. Where the first two places are directed in the same direction, the last three are diverging. People tend not to care so much about the contract in the first place, see prices always in the top three concerns and tend to care less about the pollution.

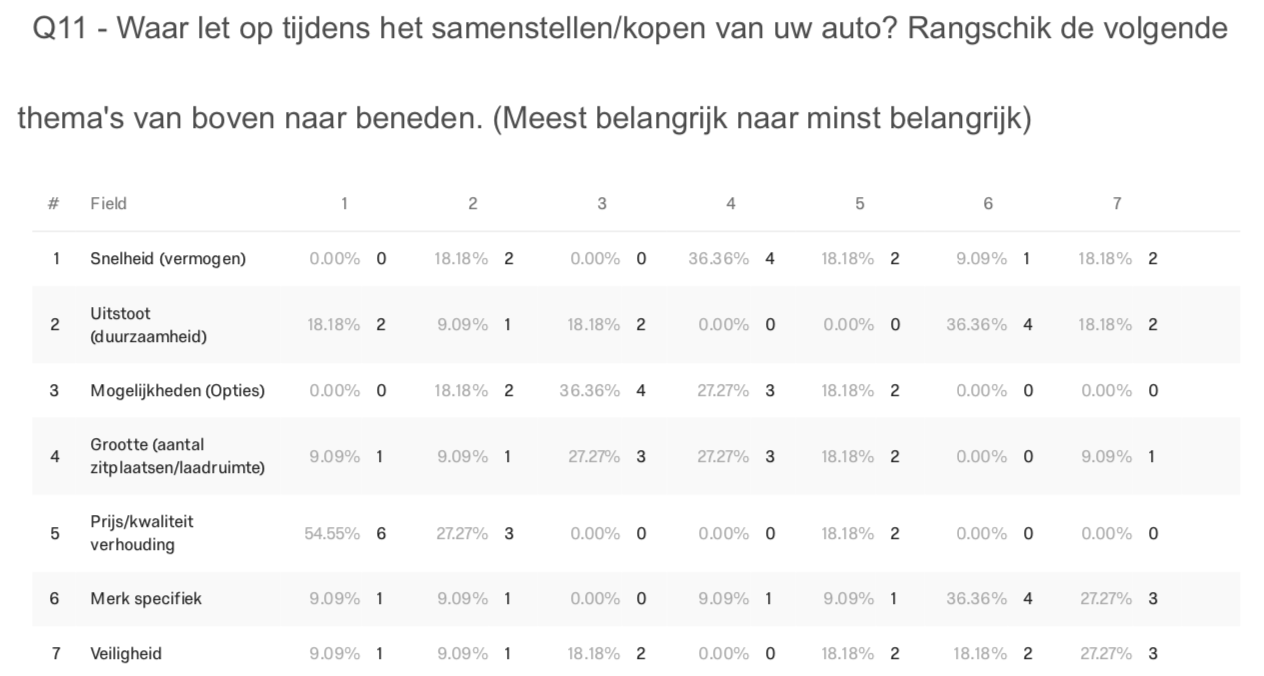

The next figure shows a similar asked question, only this one is focused on the composing of a car instead of purchasing. Looking at the figure, one thing comes clear directly, people concentrate the most on price-quality ratio, and at the same no one does at power or car-options. As second, people are diverging again, but still, most people tend to go for price-quality ratio. Within the design, I should facilitate all the options given at each price indication.

Not all participants were likely to have a lease contract, but the one who did, I asked to rank the most important contract features. The figure shows a perfect funnel interest. In the first two places, flexibility is preferred. Secondly, duration place an important role. Right after, mileage takes place four. And the least relevant feature is in included services. The figure tells me that I should take the flexibility and duration into account prominent.

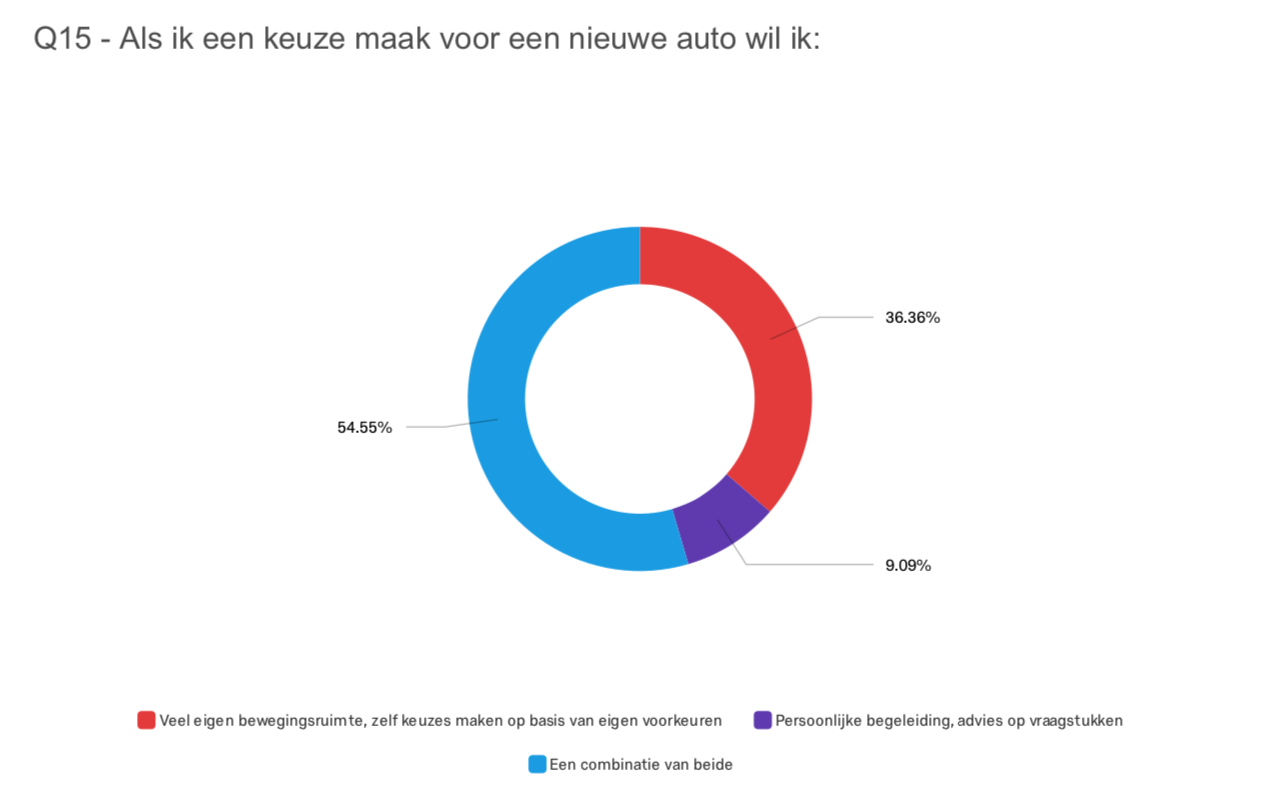

How people make decisions is really interesting information for my concept. I asked the participant if they wanted to be guided, want autonomy or have a combination of both when choosing a new car. The answers differ, but the participants mainly answer the question with a combination of both. What stands out, is that only one-tenth claims they want personal guidance only. The other two answers tell me that people do want to be autonomous, but also prefer being guided when needed.

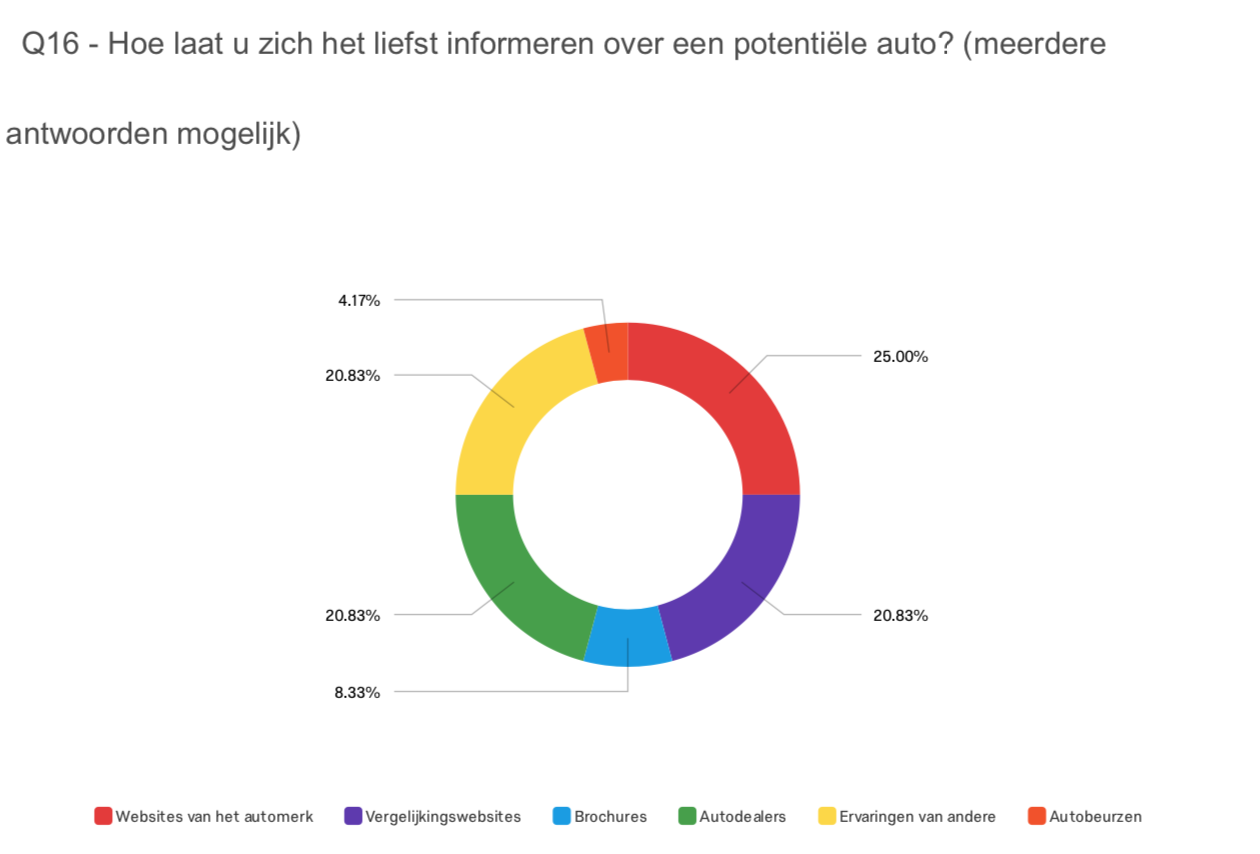

Finally, I asked how people inform themselves about their potential car. I assumed that people nowadays use the internet mainly, and the answers validate that. A fourth of the participant use websites to be informed. Comparison websites, word of mouth and car dealers, share the second place with exactly the same amount of interests. Comparison websites and word of mouth, both form a solution for the problem by facilitating the opinion of others, while car dealers are the expert reviews. The big difference is that car dealers will do everything to let you buy, while comparison websites and word of mouth let you reconsider your decision. The fact that people care much about other opinions, shows me that I should provide users with reviews and ratings at product pages, or model overviews. And next to that, people are more likely to be more expertly informed by car dealers, which means I should not use difficult content that people need to figure out themselves.

Last updated